Key findings

- The private sector has a key role to play in solving the biodiversity crisis and the voluntary carbon market (VCM) has become an important source of finance for investments in nature-based solutions.

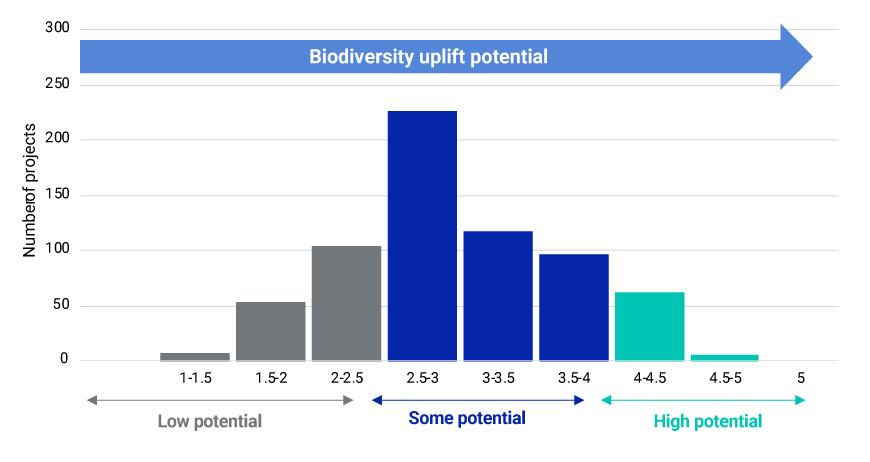

- Quantifying the scale of ecosystem benefits is complex, but our analysis suggests that two-thirds of 670 afforestation/reforestation projects in the VCM could materially improve biodiversity; 10% have high potential.

- By 2050, the global carbon-credit market could provide up to USD 100 billion per year of finance for nature-based solutions, potentially at relatively moderate costs.

COP16, taking place in Cali, Colombia, will focus the attention of governments, companies and investors on the struggle facing nature. The sobering background to the “biodiversity COP” is that the world lost 16% of humid primary forest cover over the last 20 years,[1] and wildlife populations declined by 73% between 1970 and 2020.[2]

For investors, the challenge is equally complex. Beyond identifying risks and mitigating negative impacts, they must identify opportunities to restore and conserve nature. The Global Biodiversity Framework (GBF) highlights the need for private finance as part of its goal to mobilize USD 200 billion per year for biodiversity.[3]

The role of the voluntary carbon market

The good news is that the private sector is increasingly acknowledging the risks of nature loss and the part they have to play. Over 450 organizations have committed to nature-related disclosures through the Taskforce on Nature-related Financial Disclosures (TNFD) and 150 companies have pledged to set targets based on guidance from the Science-Based Targets for Nature, which provides an action framework for addressing nature loss.

Private finance for nature has increased more than tenfold in the last four years, totaling just over USD 100 billion as of June 2024, according to research from the United Nations Environment Programme Finance Initiative.[4] Sources of private capital include equity, debt, green bonds and philanthropy. The VCM is a growing source of private capital, with nature-based projects making up 80% of the USD 18 billion raised between 2021 and mid-2023. In these projects, nature is central to the reduction or removal of CO2 emissions. For instance, reforestation removes CO2 from the atmosphere, while protecting tropical forests reduces CO2 emissions by preventing deforestation.

Major deals in the VCM include advanced market commitments from companies like Meta Platforms Inc. and Microsoft Corp. Both have signed long-term offtake agreements for afforestation and reforestation (ARR) credits, with Meta committing to 1.3 million credits and Microsoft securing 8 million credits.[5]

The quality of nature-based carbon projects and the provision of ecosystem benefits beyond reducing carbon emissions can vary significantly. Nature-based projects do, however, make up more than half of VCM projects achieving an MSCI Carbon Markets quality rating of AA or higher.

Measuring biodiversity benefits

While supporting nature and capturing carbon seems like a win-win, quantifying the scale of the ecosystem benefits requires extra work, as each project differs in terms of location, topography, choice of tree species and composition and management practices.

Potential biodiversity benefits of ARR projects

Data as of September 2024. Analysis covers a sample of 670 registered ARR projects globally. Our assessment of biodiversity impacts considers multiple factors associated with the geography of the project area. We break these down into: (i) ecosystem scarcity, (ii) biodiversity uplift, (iii) biodiversity intactness and threat and (iv) biodiversity support. Performance in these factors is assigned a score on a scale of 1-5, with 5 representing the highest biodiversity-uplift potential and 1 representing minimal potential. Source: MSCI Carbon Markets

For example, some 66% of 670 ARR projects globally have potential for biodiversity uplift, with 10% having high potential, as shown in the exhibit.[6] Biodiversity impacts are complex and a function of several factors associated with the geography of the project area. Geospatial analysis by MSCI Carbon Markets assesses global forest carbon projects using various geographical factors to determine their biodiversity potential. For reforestation projects, this includes not only the project in its current state, but also incorporates the potential positive impact on biodiversity from a fully-planted forest and resulting reduction in forest fragmentation, or biodiversity uplift.

Country deep dive: Colombia

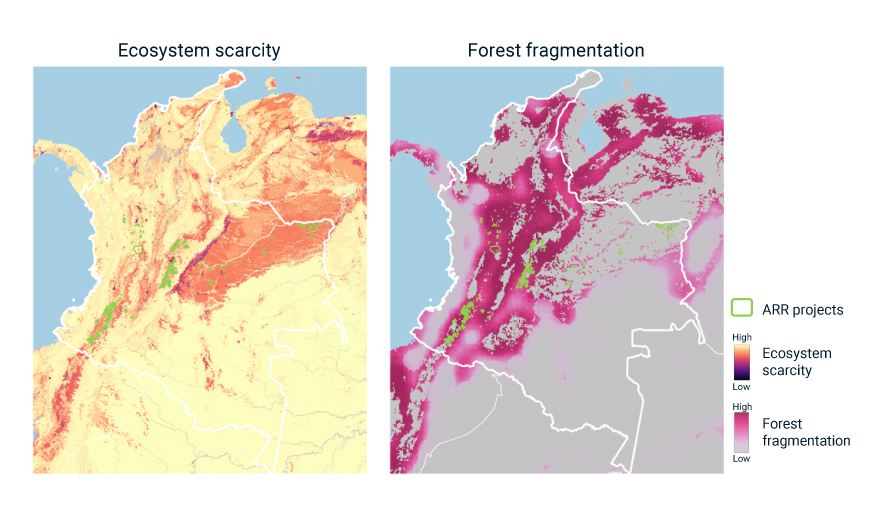

Colombia is one of the world’s most ecologically diverse countries and has used the VCM to support the protection and restoration of its forests for several years. It now has over 100 registered nature-based carbon projects, which have together issued 152 million credits to date. Of these, 63 are ARR projects, which collectively span some 500,000 hectares, covering multiple ecosystems and habitat types. Four-fifths of this area, representing 60% of the ARR projects, are in highly fragmented landscapes, indicating threats to habitats with ongoing biodiversity decline.

We calculate that the projects designed to restore these areas could boost forest connectivity by 34%, reviving specific flora and fauna in these areas.[7] The exhibit shows the degree of forest fragmentation and ecosystem scarcity across Colombia, and the location of registered ARR carbon projects. We estimate that by 2050, up to 45 million credits from high-quality reforestation projects in Colombia could be produced annually at a cost of up to USD 50 per carbon credit (representing 1 t CO2e).

Ecosystem scarcity and forest fragmentation for Colombian ARR projects

Source: MSCI Carbon Markets as of August 2024

Nature-based carbon projects — a potential USD 100 billion market

Nature-based assets create a potential win-win-win solution to climate change: capturing carbon from the atmosphere, providing significant biodiversity benefits and requiring relatively modest cost.

The global carbon-credit market could be the answer to the ongoing challenge of funding this approach. The market could be worth USD 5-24 billion in 2030, USD 20-70 billion by 2040 and USD 30-200 billion by 2050, according to projections by MSCI Carbon Markets. We also estimate that nearly half of this demand could be for nature-based solutions, creating a potential source of capital for these projects of up to USD 12 billion in 2030 and USD 100 billion by 2050. Much of the potential for nature-based projects could be delivered at under USD 75/t CO2e.

Footnotes

“Global Dashboard,” Global Forest Watch, accessed Oct. 7, 2024.

“Living Planet Report 2024,” World Wildlife Fund (WWF), 2024.

“COP15: Nations Adopt Four Goals, 23 Targets for 2030 in Landmark UN Biodiversity Agreement.” CBD press release, Dec. 19, 2022.

“Private finance for nature surges to over $102 billion.” United Nations Environment Programme Finance Initiative, June 10, 2024.

“BTG Pactual Timberland Investment Group to Provide Microsoft with 8 Million Carbon Removal Credits,” Timberland Investment Group press release, June 18, 2024. And: “BTG Pactual Timberland Investment Group and Meta Announce Long-Term Contract for Delivery of 1.3 Million Nature-Based Carbon Removal Credits, with Options for Delivery of Additional 2.6 Million Credits.” Timberland Investment Group press release, Sept. 18, 2024.

This an estimate of the potential positive impacts on biodiversity. Actual benefits are based on multiple components of project design.

This an estimate of the potential positive impacts on biodiversity, actual benefits are based on multiple components of project design.